“All ag aviation operators should be aware of futures contracts, due to market fluctuations.” The warning by the president of the Brazilian Union of Agricultural Aviation Companies (SINDAG), Thiago Magalhães Silva, may sound strange, considering the agriculture’s strength scenario in his country. Due, for example, to the expectation of Brazilian grain production reaching 309.9 million tons – according to the 2022/23 Crop Survey, released in early March by the National Supply Company (CONAB, in Portuguese acronym).

But the truth is that economic instability still threatens to be the great villain of 2023. In a year that begins with a cycle of high inflation in the world and Brazil with the new government fixing the house. Added to this is the announcement of a tax reform with a possible increase in the tax rate, the devalued real against the dollar and the country’s basic interest rate (SELIC rate) maintained at 13.75% per year.

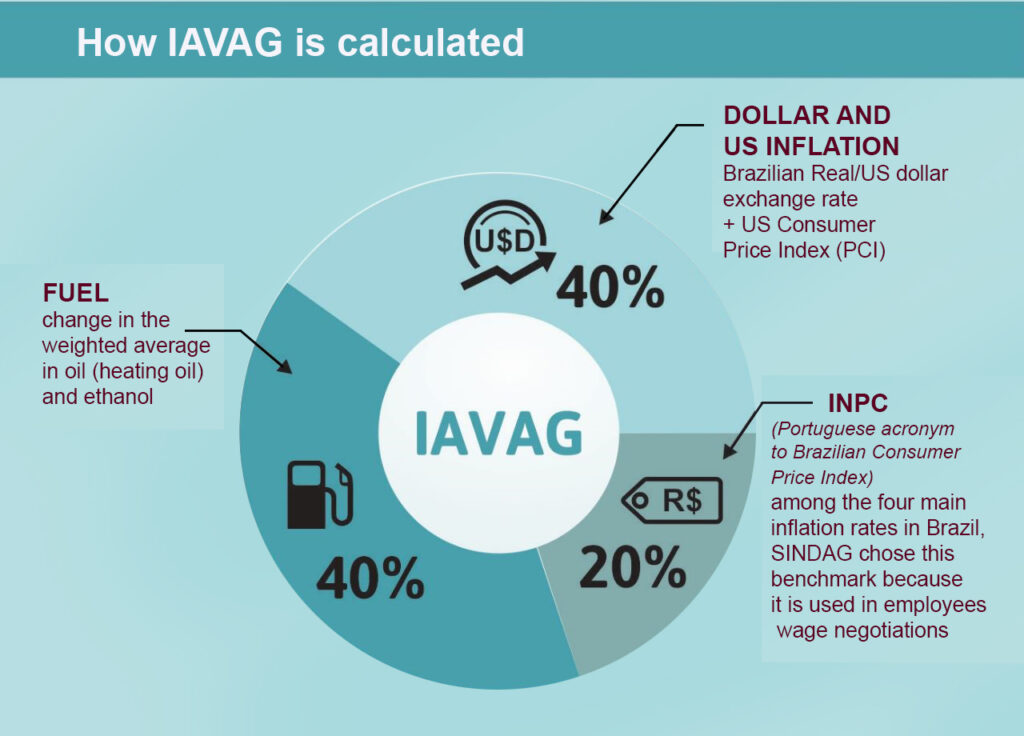

As a result, the Agricultural Aviation Inflation Index (IAVAG, created by SINDAG to mark out contracts for aerial applicators) reached an accumulated (from January to December 2022) of 11.47%, leveraged by fuels – oil (heating oil) and ethanol, which rose 42.37% in the year. Already, in 2023, despite the January index having fluctuated downwards (-2.21%), in February the variation was high again, with 1.29%.

“The IAVAG provides an indication of the main costs of agricultural aviation. For this reason, it is important for operators (commercial and private) to be aware of this variation,” points out Magalhães Silva. According to him, it is a particularly good benchmark, “but the manager also needs to have his cost spreadsheet, as each operation has its specificities.”

A GREAT VILLAIN

Another recommendation for operators is to be aware of federal government measures, especially in relation to fuel – the great villain in the past, with an accumulated increase of 42.37% from January to December, according to IAVAG. According to the SINDAG’s Chief Operating Officer (COO), Cláudio Júnior Oliveira (economist and person responsible for calculating the IAVAG), the index was not higher only because the federal government suspended, since May 2022, the collection of two types of taxes: the PIS/PASEP ( percentages between 1% and 2% on payroll, billing or imports – depending on the type of company – charged to finance social security), COFINS (percentage of 3% or 7.6% on gross revenue, depending on the type of company, to public health and social security) and the CIDE on fuel (to finance environmental projects in the oil and gas sectors and transport infrastructure) . In addition to limiting the ICMS (Tax on Circulation of Goods and Services) to 17%, charged by the States.

The COO points out that the Brazilian government’s effort to ease taxes on fuel demonstrates how much this input is also a sore point for the other inflation indices used in Brazil. They affect, for example, all items that are part of the calculation of the Extended Consumer Price Index (IPCA), which is calculated by the Brazilian Institute of Geography and Statistics (IBGE). It is considered the official thermometer of inflation in Brazil and reflects the cost of living and the purchasing power of the population in the country. Included in its composition are expenses with clothing, food, hygiene, and transportation. And everything requires the use of fuel because everything goes through logistics.

“The premise is so true that the decrease in taxes on fuel also reduced the National Consumer Price Index (INPC) – used to measure the purchasing power of wages. Indicator by which in July 2022 Brazilian inflation would have dropped from 1.71% to -0.6%”, recalls Oliveira. Remembering that fuels did not inflate bills only in Brazil. In the United States, President Joe Biden had to travel to the Middle East to negotiate an increase in oil production to reduce prices in his country.

OFFER – DEMAND

The rise in oil prices seen in the first half of 2022 began to take shape at the beginning of the Covid-19 pandemic, in March 2020. At the time, fuel production was high and, suddenly, everything started to stop. With products stranded by the drastic decrease in fuel demand in the market, the price of a barrel of oil ended up plummeting. As a result, the Organization of Petroleum Exporting Countries (OPEC, made up of the thirteen largest oil exporting nations and which regulates oil production and marketing), reduced production.

At the end of the pandemic, with a return to normality, production remained low, reversing the situation: a lot of demand and little supply. What got even worse after Russia invaded Ukraine in February 2022, when several countries restricted the purchase of Russian oil, further increasing the shortage. So much so that on March 7, 2022, a barrel reached $140. “This was unprecedented and has become a major global economic problem,” points out Oliveira.

WARNING LIGHT

Another warning sign for Brazil comes from rising indices in the United States as well. Even more so considering that the ag aviation sector buys a good part of its aircraft, parts, accessories, and technologies from North American manufacturers.

The main economy in the world closed 2022 with an accumulated inflation of around 6.5% (according to the CPI – Consumer Price Index). In January of this year, it was 6.4% and in February at 6.0%, an index that should be repeated in March, according to estimates by the U.S. Bureau of Labor Statistics. This situation even caused the American currency to lose market value. “Even so, the Real continues to be devalued against the dollar due to several factors, such as political and market instability,” observes Oliveira.

Since November 2021, the dollar has not dropped from the level of five reais. The problem was when the American currency went from R$ 3.87 in December 2018 to R$ 5.38 in August 2021, representing a 39% increase. A blow to those who have debts in dollars. For example, a portion of the debt of an aircraft in December 2018 in the amount of U$$ 300,000, increased to U$$ 417,000 in 2021. Therefore, it is important to evaluate both sales and purchase agreements for aircraft and equipment because the problem is not inflation itself, but the volatility caused by global economic and geopolitical changes.

Uncertainties about reforms and expectation of a super harvest

The economic scenario and political moves between the federal Brazilian government and the National Congress for possible legislative reforms (especially regarding taxes) increase the requirement for high-performance economic management to survive the economic instability that threatens 2023. “Right now, it is necessary to seek stability through financial strength – called savings by some economists and cash by some managers,” says the SINDAG’s COO, Júnior Oliveira.

Although the moment is challenging, the indication of a super harvest in Brazil (surpassing the mark of 300 million tons of grains for the first time) makes the moment propitious for companies to build adequate financial health. However, warns the Sindag director, it is up to managers to pay attention to some points regarding the economy:

IVA

There are many edges still to be trimmed and that will certainly influence the indices that make up the IAVAG. Oliveira cites as an example the proposal by Federal Deputy Baleia Rossi (MDB/SP), to create the Added Value Index (IVA, in the Portuguese acronym). It is a single tax, which would replace the current taxes on consumption: the PIS/COFINS and the Tax on Industrialized Goods (IPI) – federal excise taxes; Tax on the Circulation of Goods and transportation and communication Services (ICMS, a state sales tax), and the municipal services tax (ISS, a municipal tax).

Baleia Rossi’s project has been in progress since 2019 in the Chamber of Deputies (the Brazilian House of Representatives) and was drafted by economist Bernard Appy, currently Secretary of Tax Reform at the Ministry of Finance. Appy has already expressed the intention that the VAT reference rate be 25%. According to Rossi, Proposal for Amendment to the Constitution (PEC) No. 46/2019 made little progress last year, but in 2023 it has the sympathy of the new federal government.

For this reason, Oliveira advises ag aviation operators to pay attention to the tax reform – if on the one hand it simplifies accounting by uniting the five taxes, on the other hand this can serve as an excuse for the government to raise the rate. He also recommends keeping an eye on inflation – including in the United States, which quickly reflects on the technologies, equipment and components used in aerial applications.

POSITIONING

It is also important to keep an eye on the positioning of the Brazilian Central Bank (BACEN), responsible for setting the interest rate to combat inflation. In this case, the index of the Special System of Liquidation and Custody (SELIC – the official basic interest rate of the Brazilian economy). Index that in March was maintained at 13.75% – the same index of September 2022, where it reached after 13 consecutive increases (starting from 2% in March 2021).

According to Oliveira, maintaining the high index occurs for at least three reasons. First, to combat market uncertainties, which were accentuated in view of the external environment that deteriorated due to the closure of two regional US banks and the credit Suisse liquidity crisis. Second, due to Brazil’s need to follow the monetary policy of the central economies that are on a contractionary trajectory. And third, as a simple and direct message for the federal government to rein in public spending, starting, for example, with a good fiscal reform. “As long as BACEN, which is Brazil’s independent monetary authority, does not lower the interest rate, we can understand that instability still surrounds the economy,” points out the IAVAG coordinator.

Good scenario for Brazilian exports

Economist André Diz, professor of the MBA in Agribusiness Management at Fundação Getúlio Vargas (FGV) and researcher at FGV Agro, sees the world economic scenario with certain optimism in relation to Brazilian agribusiness. But he also reinforces that it is necessary to have efficient business management – to produce at the lowest possible cost and, in the case of the producer, to sell at a price that pays the profitability he wants. Diz recalls that the stable exchange rate at a high-level favors Brazilian export – which gain competitiveness. But on the other hand, imports remain expensive.

The expectation is that the dollar will remain stable at around R$5.30 this year, plus inflation in the United States. Which will represent an increase in the cost of production for the farmer who imports fertilizers and pesticides – although the price of fertilizer on the domestic market at the beginning of 2023 was already 13% lower than the amount paid at the beginning of last year. “So, this will provide some relief in terms of production costs for farmers, despite the fact that the price of a sack of soy has fallen by 10% (in reais) over the same period of time”, points out the economist.

The large difference between values in real and in dollar is also not comfortable for ag aviation operators, who are paid in real for their services, but buy aircraft, parts, and accessories with prices in US currency (items that, in addition to of the exchange rate difference, had an increase in dollars due to US inflation). In this scenario, the economist points out: “the good news is that with the increase in the harvest, the demand for agricultural aviation services also increases.” The researcher from FGV Agro sees Brazilian agribusiness in line with the pace of the world economy and with positive prospects considering good economic activity in the United States. “Very heated job market, still with inflation problem, but an economy that has been performing very well,” he observes.

GROWING ECONOMY

At the other end, China, Brazil’s main trading partner, also presents economic growth indicators. That’s according to the latest trade reports from the International Monetary Fund (IMF) – which is good for Brazilian agricultural producers. “The world is on a lower growth trajectory than in the pre-Covid 19 period, but better than expected since mid-2022”, says Diz.

“It is no coincidence that Brazil grew 2.9% last year and this year it should grow 1%”, contextualizes the economist. In the case of China, the IMF projected, in October 2022, a growth of 4.4% for 2023, with a GDP of US$ 17.95 billion. Adjustment motivated by the end of the Covid Zero policy in December 2022. “As a supplier of commodities to them, it will be very good for Brazil,” highlights the economist.

Planning to mitigate exchange differences

For Professor Cristian Foguesatto (PhD in Agribusiness and PhD student in Administration), in addition to good financial planning, fluctuations in the global economic scenario in recent years have required operators to be very aware of their costs when pricing services. According to him, that is why it is important for them to see how these international fluctuations affect their bills – from aircraft, components, and accessories to heating oil. “This is all indexed in dollars. So, any problem in the United States affects costs here in Brazil,” he points out.

For this reason, SINDAG and the Brazilian Institute of Agricultural Aviation (IBRAVAG) are investing heavily in training courses, such as the MBA in Ag Aviation Management, Innovation and Sustainability (which Foguesatto has among its professors), economic management courses, mentoring for entrepreneurs and update lives. “For the agricultural aero operator, it is not enough to simply cover costs and have a profit margin of 5% or 10%. He has a high-risk activity, including accidents (which in most cases are fatal) and a life is priceless,” he highlights, about the need for constant investment in equipment and technologies.

At the same time, the professor points out that this dependence on a stronger currency, although it is an obstacle, does not qualify it as a villain, but just a mishap. “Which can be overcome with excellent administrative and operational management.”

AIR TRACTOR: 50 turboprops delivered to Brazil per year

Even with all the uncertainties in the economic scenario, Brazilian agricultural air operators continue to expand or renew their fleet. According to Air Tractor’s finance manager, Phil Jeske, the manufacturer delivers an average of 50 turboprop aircraft per year in Brazil. Which should increase in 2023, strengthening the position of Brazilians among its main customers. “More than 25% of Air Tractor’s revenue comes from Latin America, mainly from Brazil”, points out the executive. In fact, according to him, in three of the last five years – 2018, 2019 and 2022, Brazil was the largest market in Latin America for the Olney factory in Texas.

Photos: Air Tractor

Jeske explains that the interest of the Texan manufacturer is also reinforced by the fact that Brazil is the fourth largest agricultural producer in the world, in addition to having highly technical and regulated agricultural aviation. As a result, in addition to supplying more aircraft, the factory’s strategy is also to focus on improving aircraft efficiency and the quality of after-sales support.

The leap in the presence of turboprop aircraft in Brazilian agricultural aviation has been visible for more than 10 years in the annual fleet survey carried out by SINDAG. The person responsible for the survey is the former director and consultant of the Brazilian Ag Aviation Union Eduardo Cordeiro de Araújo. According to him (who is closing the numbers for 2022), preliminary data show that, until December 31, there were 552 active Air Tractor aircraft in the country. In other words, 57 more than in the previous year.

Watch out for market fluctuations

Photo: Serrana Aviação Agrícola

With a fleet of 17 Air Tractor turboprops and three Embraer Ipanema – domestically manufactured and with a piston engine, Serrana Aviação Agrícola feels the uncertainties of the global economic scenario on a day-to-day basis. As most of its fleet uses oil-derived fuel, the input weighs heavily in the accounts of the Mato Grosso do Sul agricultural air operator. “From the beginning of the 22/23 harvest in August until March of this year, fuel prices continued to rise”, points out director Caio Balzan, who also works as a pilot at the base in São Gabriel do Oeste.

For Balzan, with the unpredictability of the international situation, especially on the exchange rate and oil, it is essential to be attentive to the fluctuations of the global market. “It is important to price based on what can happen,” he advises. He hints that it comes from experience dealing with annual and even two-year agreements.

The other concern pointed out by the pilot is related to field operations: complying with legislation on the sector, making quality applications with maximum safety. “We need to preserve the image of agricultural aviation as a fundamental and safe tool to protect crops,” observes the executive. He recalls that it is necessary to show society that agricultural aviation is effective and protects nature.

In addition to efficiency, it is important to show that the operators maintain decontamination systems for the aircraft, the applications are made only with agronomic prescriptions and the operators send monthly reports of all their field operations to the Ministry of Agriculture. “The idea is to make people feel safe and not to give room for radicalism based on fake news against the ag aviation” points out the pilot.